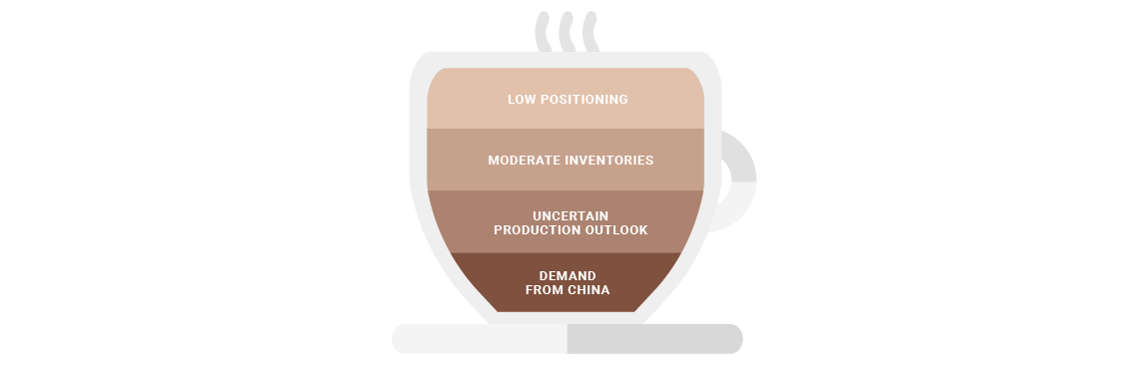

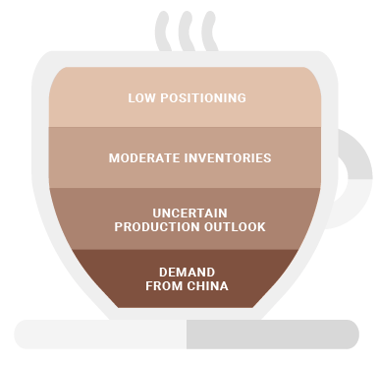

At around $125 per 100 pounds Coffee is trading near the bottom of the long term range. In fact the commodity has not traded below $100 since 2006 and was only very occasionally below $120 while surging to as high as $300 in 2011 and above $170 four times in that timespan. We highlight four factors that could see coffee prices higher at the end of 2018.

Increased popularity in Asia - a bulk of demand for coffee comes from Europe and the US but when we look at demand evolution it’s Asia that is starting to play an increasingly large role. Even though China and India account for over 35% of global population, their share of the coffee market is just around 3%. This could change as Starbucks alone opened 5000 stores in China in 2017 and growing middle-class can herald a lasting change in demand trends.

Relatively low inventories - a level of inventories plays an important role for commodity pricing. A low level means that any supply shock is tougher to absorb and requires a stronger price adjustment to balance the market. In case of coffee, a ratio of stocks-to-use is at around 0.22, near a bottom of a 0.18-0.35 range for the past 15 years. Should we see any supply disruptions, prices could explode higher.

Uncertain supply outlook - the reason why coffee prices declined in 2017 was a vision of a well balanced current 2017/18 season and Brazil-led oversupply in 2018/19 season. However, the outlook has deteriorated lately and this season could eventually see a deficit this year and Brazilian output can be negatively influenced next season by the La Nina phenomenon. Since investors seem be discounting a well supplied market, any disruption could be positive for prices.

Extremely low positioning - a level of positioning by financial investors can be a good indicator for a downside or upside of the market. It is understandable that when a flow of news is gloomy and prices are weak, investors’ interest could be low but a very low level of positioning can fuel a price rally of the news improves. For coffee the level of positioning according to the CFTC data is the lowest ever at -34 thousand contracts.