- Very tight spreads: from 0.00001 for both EURUSD and GBPUSD

- No swap charges on equity indices and various commodities (including oil)

- No requotes and guaranteed stop loss on Basic account

Can the Bitcoin rally persist?

30 August 2017

Report by Przemysław Kwiecień

Chief Economist at XTB

David Cheetham

Chief Market Analyst

- The price of Bitcoin has rallied over 350%* so far in 2017, but can the rally persist?

- Can we put a valuation on Bitcoin?

- Renowned investors and analysts see a bright future for Bitcoin - but why?

- How to analyse Cryptocurrencies from a technical perspective for potential trade opportunities

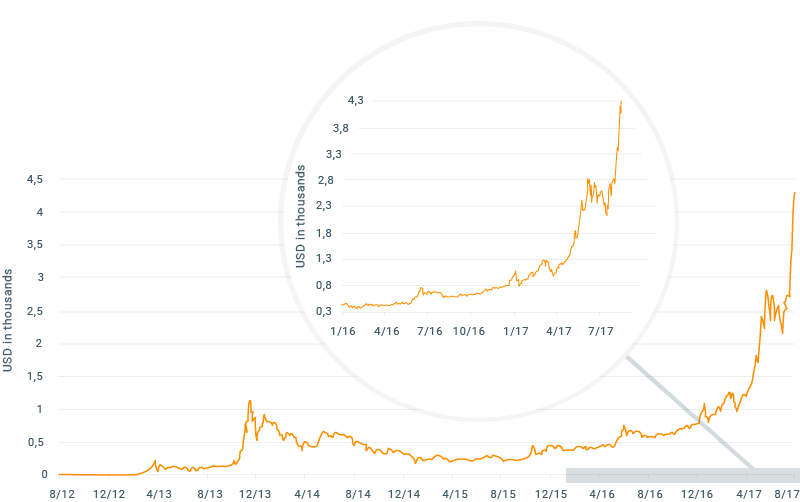

Bitcoin price in USD

Source: Macrobond, data covering 17.08.2012-17.08.2017

*Source: Macrobond, data covering December 31 2016 to 17 August 2017

5 Year BTC Chart

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Introduction

Bitcoin is a breakout star of the financial markets so far this year. Its value, along with other cryptocurrencies like Ethereum or Litecoin, has skyrocketed over recent months and captured the attention of traders and investors alike who have been unable to find satisfying returns on traditional markets. In this report, we analyse reasons behind this surge in price and take a closer look at theories and predictions of the future of Bitcoin. We also discuss whether cryptocurrencies could be analysed with popular technical analysis tools.

Section 1

From $400 to $4000 - how Bitcoin evolved over the past 18 months

There was a time when one Bitcoin was worth less than one US dollar - but if we compare this to current prices, it becomes a complicated case of analysis. Indeed, over the past 18 months alone Bitcoin’s value has increased tenfold, from from around $400 in the first quarter of 2016 to more than $4000 by mid-August of 2017. Below we present some interesting milestones for Bitcoin that could help understand what may have driven the price so far.

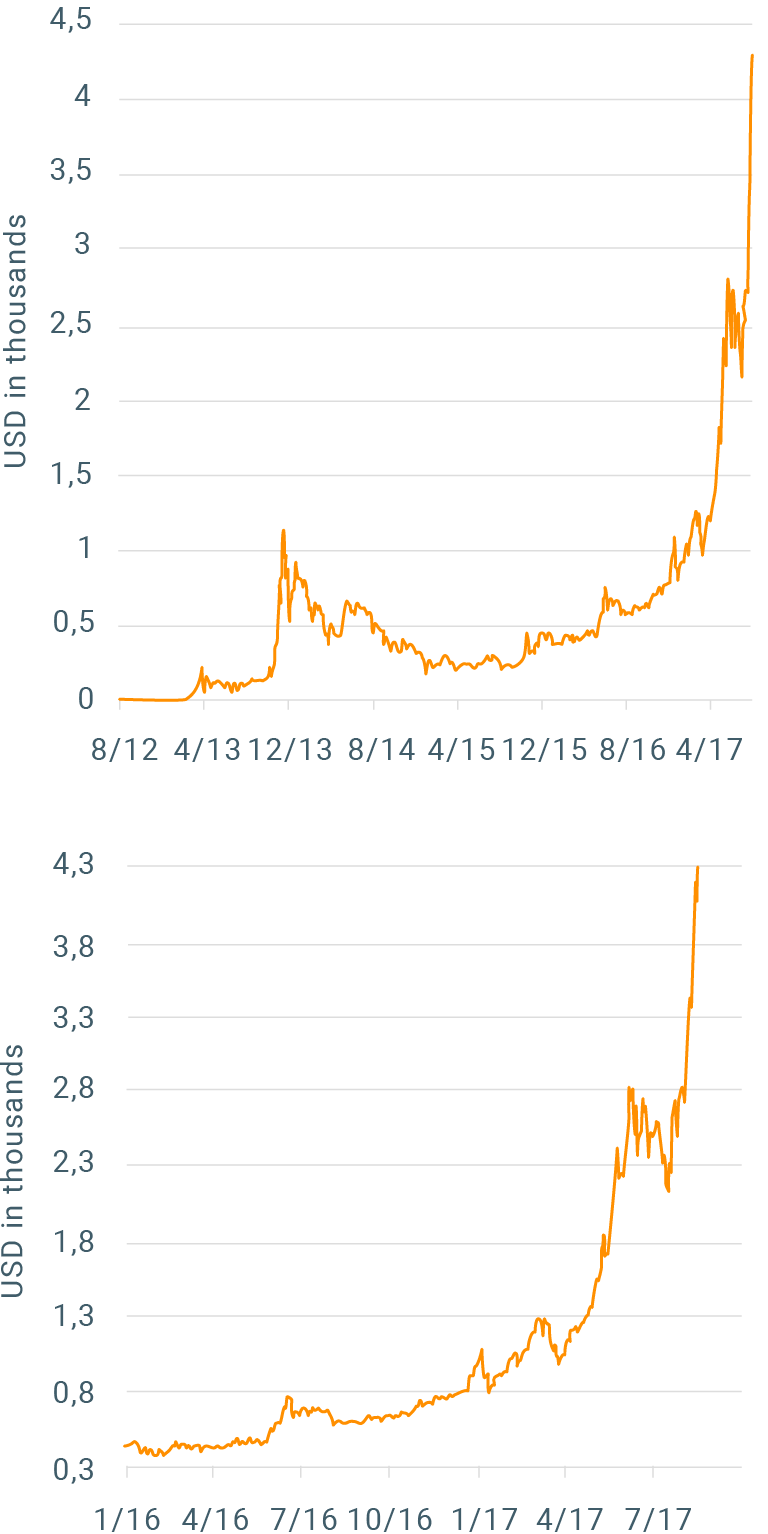

Bitcoin price in 2016

Source: Macrobond, XTB Research, data covering 01.01.2016-31.12.2016

- Bitcoin starts the year poorly with 2016 seeing Mike Hearn, one of its well-known developers within the Bitcoin community, declaring that the project had failed and he would no longer take part in development

- SegWit is yet to be fully implemented, but is discussed by influential community members at a Hong Kong Roundtable in February 2016

- Craig Wright, an Australian computer scientist and businessman, claims to be Bitcoin founder Satoshi Nakamoto, which is disputed within the community

- Second Halving Day - on July 9 a reward for solving a block halves to 12.5 Bitcoins, reducing the reward for miners and a pace of BTC supply growth. The next one is expected by 2020

- Bitfinex, the largest Bitcoin exchange by volume, announces that nearly 120,000 BTC has been stolen via a security breach

- Donald Trump wins US elections, Bitcoin reacts by rising 5% over the first 24 hours showing a resilience in a face of volatility in global markets

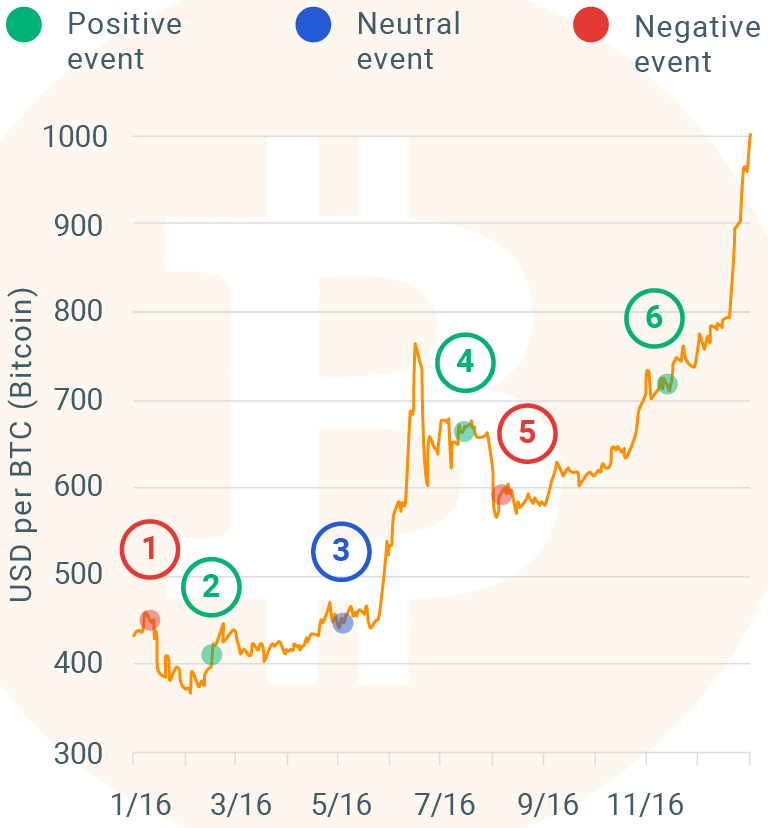

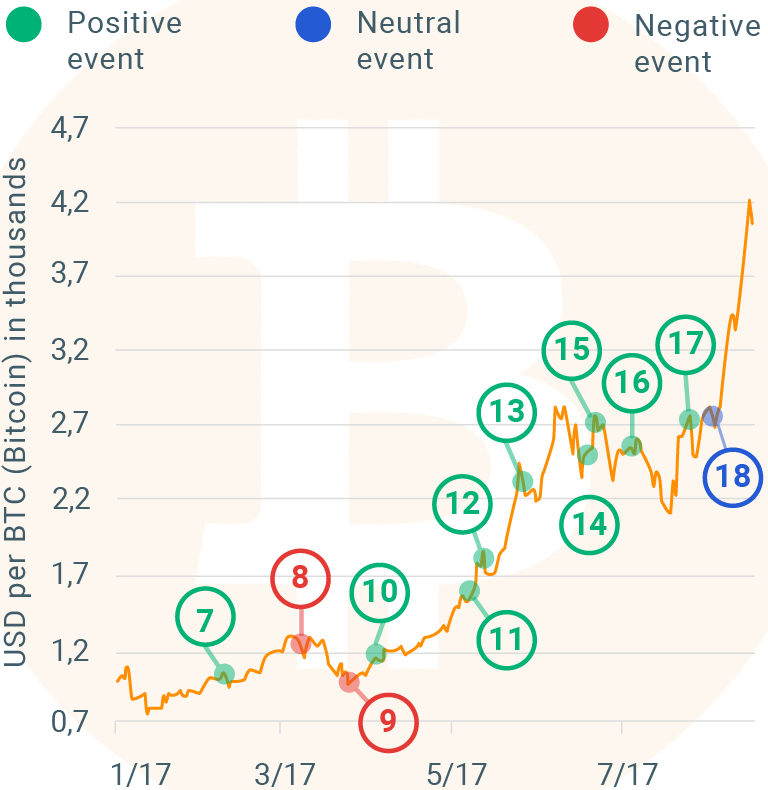

Bitcoin price in 2017

Source: Macrobond, XTB Research, data covering 01.01.2017-17.08.2017

- The Philippines legitimise Bitcoin as an official payment method

- The US SEC denies the application of Tyler and Cameron Winklevoss to operate a Bitcoin ETF

- The SEC denies the application of SolidX Bitcoin Trust, an ETP (exchange traded product) that would trade like a stock

- Japan declares Bitcoin a legal tender, categorising it as a kind of prepaid payment instrument

- Australia eliminates goods and services tax on Bitcoin purchases

- Ulmart, a leading online retailer in Russia, announces plans to start accepting Bitcoin payments

- Peach Aviation Ltd. becomes the first carrier in Japan to accept Bitcoin payments in a bid to attract more customers

- A government in India announces a decision to regulate the cryptocurrency market to even a playing field for Bitcoin exchanges. This is perceived as a major step towards Bitcoin acceptance

- Falcon, a Swiss bank, announces that private banking clients will be able to store and trade Bitcoins via their cash holdings in the Bank, in a move that could suggest that cryptocurrencies are becoming an investable asset class

- Bitcoin users in Japan no longer pay 8% consumption tax on Bitcoin transactions

- LedgerX, an institutional trading and clearing platform for Bitcoin, becomes the first platform in the United States cleared for trading by the CFTC

- “Hard Fork” arrives as blockchain splits into Bitcoin and Bitcoin Cash. A move that had been feared for a long time has not affected the Bitcoin blockchain in a significant way which has been seen as a promising omen

It is not hard to see that 2017 in particular has been dominated by positive news. Governments - especially in Asia - along with businesses, broadened their acceptance of Bitcoin, a precondition for the blockchain’s success. On the other hand, major disruptions including theft and attackers from hackers that plagued Bitcoin in the past (with the Mt.Gox collapse as the biggest one) has been absent since the Bitfinex scandal. That contrast helped fuel a giant rally in prices, but the question remains as to whether this could last. In the remaining sections of this article, we take a look at potential ways to answer this question.

Section 2

Is it possible to put a valuation on Bitcoin?

The first step in formulating any valuation is finding out what an intrinsic value of an asset could be. Intrinsic value would tell us what an asset is worth provided that we have every piece of information at our disposal. Because we don’t, we need to make assumptions and make estimations and therefore intrinsic value is a rather vague concept. In some cases it’s more tangible whereas in others even making assumptions could be tricky.

Consider equities and finding the intrinsic value of a share. If we know of financial reports and the overall economic situation, we can make assumptions about future developments and discount future profits into today’s value. Different analysts will make differing assumptions and so they will arrive at sometimes quite radically different valuations. However they would normally at least agree on valuation methods that are well sanctioned by financial literature. This is not the case with Bitcoin.

Bitcoin does not earn profits or pays dividends, so any sort of analysis that is applicable to equities would not work on this case. Because Bitcoin does not represent any single economy we cannot treat it as a traditional currency which could be modelled using macroeconomic variables and interest rates. In order to attempt any sort of Bitcoin valuation one may need to think outside the box. One of the approaches could measure Bitcoin’s utility as a means of payment/money transfer.

The main purpose of Bitcoin and underlying blockchain technology in its case is facilitating payments. These payments differ in many ways from a traditional banking system but the utility for a user is derived in a similar way. Let us consider a cost of transferring money with Bitcoin. Fees paid to miners fluctuate but have been approximately $2 per transaction in recent times. This is lower than the cost of international money transfers via traditional banking systems which in Europe commonly ranges between $5 and $10. So from a user point of view, the blockchain is cheaper. However, the total cost of a transfer is a combination of fees and a value of a reward that miners receive for solving a block. This reward is currently 12.5 BTC per block and is bound to decrease over time. When all 21 million Bitcoins are mined, miners will be rewarded by fees only so it makes sense to look at the combined cost of confirming a transaction. At the current Bitcoin price of $4300 a reward is worth nearly $54,000. Because there are about 1800 transactions confirmed in each block this “cost” can be spread across them and when added to a fee it rises to $31.86 - significantly higher than in the case of the banking system.

However, it makes sense to look forward (a bit like in case of a tech stock that might be incurring losses now but offer huge rewards down the road) so we’ve simulated a transaction cost in five and 15 years’ time. We know more or less how the reward for solving a block will decline and for simplicity we assume that fees paid by a user will remain constant at $2 per transaction. We also assume that Bitcoin price increases 10% annually - at a much slower pace than thus far. We do not know how many transactions will be processed in a block in the future but because of the SegWit2x implementation (which is already taking place) but we assume that this capacity will double. This way, we arrive at a transaction cost of $14.02 in 2022 and $5.90 by 2032.

A simulation of transaction costs in the Bitcoin blockchain

| BTCUSD | BTC/block | "cost of a block" | fees | transactions in a block | transaction cost | |

|---|---|---|---|---|---|---|

| Currently | 4300 | 12,5 | 53750 | 2 | 1800 | 31,86 |

| 2022 simulation | 6925 | 6.25 | 43282 | 2 | 3600 | 14,02 |

| 2032 simulation | 17962 | 0,78125 | 14033 | 2 | 3600 | 5,90 |

| Source: XTB Research | ||||||

| BTCUSD | BTC/block | "Cost of a block" | Fees | Transactions in a block | Transaction cost | |

|---|---|---|---|---|---|---|

| Current | 4300 | 12,5 | 53750 | 2 | 1800 | 31.86 |

| 2022 simulation | 6925 | 6.25 | 43282 | 2 | 3600 | 14.02 |

| 2032 simulation | 17962 | 0.78125 | 14033 | 2 | 3600 | 5.90 |

| Source: XTB Research | ||||||

In this simulation, the cost of transaction using Bitcoins reaches the current cost of the banking system only by 2032 but it’s worth bearing in mind that the banking system will adjust over time and could offer much more competitive fees today. Would that suggest that a current Bitcoin price is too high and/or assumption of 10% annual price increase is too optimistic? We will leave it for readers to conclude. One needs to keep in mind that when we change assumptions about amount of transactions in block we can obtain different results. Furthermore, Bitcoin has more features than just cost. It is also has a time of confirmation that at present is much shorter than in banking system as well as the privacy trait that is valuable for many (including shadow economy). On the other hand, it might be the case that rival technologies (including blockchain ones) will capture market share from Bitcoin offering cheaper and more efficient services. Therefore this simulation is only for demonstrative purposes. In the next section we present some interesting third party views on Bitcoin price.

Section 3

Bitcoin theories and predictions

In the previous section we presented one way of looking at Bitcoin valuations. However with cryptocurrencies being so new on the market and their price action explosive, there are many views, some of which are radically different. Many opinions include merely price targets without details or valuation methods. In this section we present selected views, in which some from of valuation-based approach has been present.

Ronnie Moas - $7,500 in 2018

Ronnie Moas is a respected equity analyst in the United States and claims to be ranked #9 stock picker between 2008 and 2017 in a group of 4,558. His approach is to compare Bitcoin to the Internet in the 90s and treat cryptocurrencies as an investable asset class. His original forecast of $5000 price in 2018 was based on the fact that a capitalisation of cryptocurrencies was just at 1/25 percent of global capitalisation of stocks, bonds, gold and cash. Moas is sure that when these currencies are established as an investable asset class, this share will increase to at least 2 percent and currency prices will be 100 times higher. Moas changed his forecast to $7500 in 2018 after Bitcoin price broke the $4000 barrier. Do notice that there is no mathematical formula between a share of cryptocurrencies in an array of investable assets and the price of Bitcoin and therefore the price target is Moas’ guess in this case.

Tom Lee, Fundstrat Global Advisors - at least $20,000 by 2022

Tom Lee, ex-chief equity strategist at JP Morgan, is the first renowned Wall Street strategist to issue a forecast on Bitcoin price. He constructed a model that assumes a growing substitution from gold into Bitcoin. He noted that market capitalisation of gold was above $7.5 trillion, 130 times above Bitcoin’s. He sees investors treating Bitcoin as a store of value and central banks starting buying cryptocurrencies when their market capitalization exceeds $500 billion, providing legitimacy of those currencies and inviting additional demand from investors.

Kay-Van Petersen, Saxo Bank - $100,000 in 2027

Petersen’s forecast is among the most bullish of all as it assumes annual rate of return of nearly 40% for the next ten years even at the current Bitcoin price. Petersen thinks that cryptocurrencies will capture 10% of the total currency trading volume (over $5 trillion daily) within a decade and Bitcoin could enjoy a third of this pie. He notes that a daily traded volume is typically about 10% of capitalisation in the case of Bitcoin and that would take its cap to $1.75 trillion. Keep in mind that Petersen did not lay out assumptions indicating why cryptocurrencies would reach that level of trading so again one needs to be careful with this kind of valuation.

Jeremy Liew, Peter Smith - $500,000 by 2030

If Petersen’s view isn’t bullish enough Jeremy Liew, the first Snapchat investor and Peter Smith, CEO of Blockchain have an even bolder one. They see Bitcoin prices at $500,000 by 2030 and even provide a calculation behind this forecast. They assume that network users will grow by a factor of 61 until 2030 to reach 400 million. They see a popularisation on Bitcoin-based remittances and mobile penetration supporting this tendency. Moreover, they assume that each user would hold Bitcoins worth $25,000 and thus arrive at a market cap of $10 trillion. With a supply of around 20 million that would leave the price at $500,000. Obviously a number of users and their average Bitcoin holdings are huge question marks in this calculation.

BitVal model - below $2,200

Many opinions and theories on Bitcoin prices lack discipline that is required by valuation modelling. The Financial Times presented an approach of an analyst who chose to stay anonymous and constructed a BitVal model where Bitcoin price is linked to a percentage of money laundering in the global GDP. BitVal assumes that a relationship between the price of Bitcoin and the extent of global money laundering should be stable in a longer run because Bitcoin is often used to transfer money without regulatory oversight. The model uses data between January 2014 and May 2017 and even at a price of $2,200 finds the cryptocurrency to be grossly overvalued. However, one could question a chosen range of the data as Bitcoin has become far more popular since January 2014. Even if the BitVal estimate could be questioned it shows that some observers perceive Bitcoin’s utility as a means of transferring money outside of governments’ control.

Please be aware that ideas presented above are third party predictions and as such are not a reliable indicator of future performance. XTB will not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Seeing a giant rally in Bitcoin price so far, one could ask if this is already a bubble?

Section 4

Is Bitcoin in a bubble?

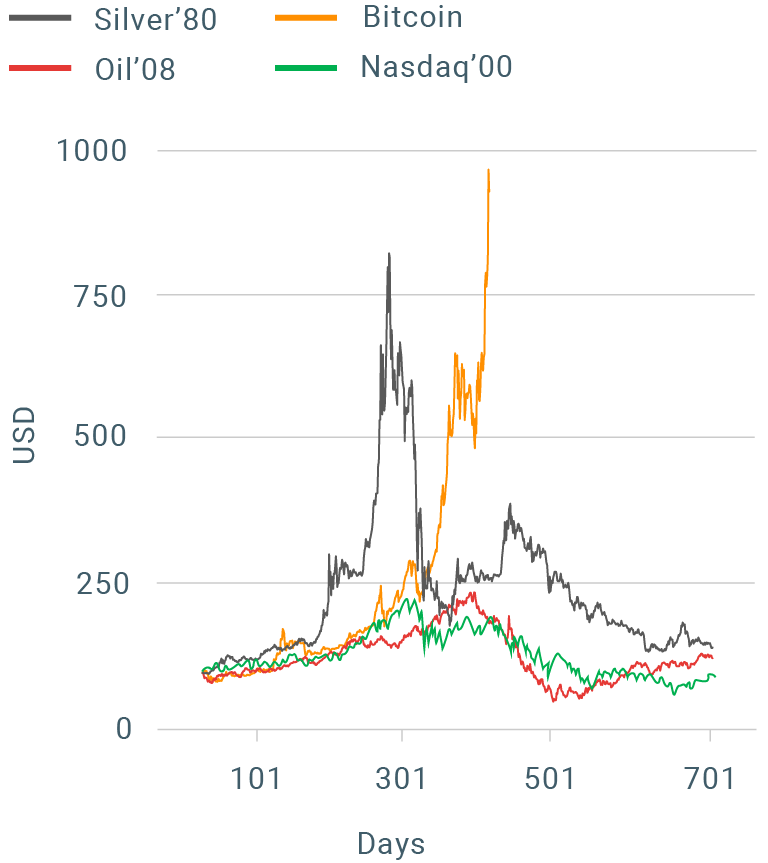

Speculative bubbles are not new to financial markets. From tulip hysteria, through South Sea Company, through British railway mania and the most recent dot.com bubble, investors from many generations witnessed an euphoria of a boom and a panic of a crash. Is Bitcoin next in line?

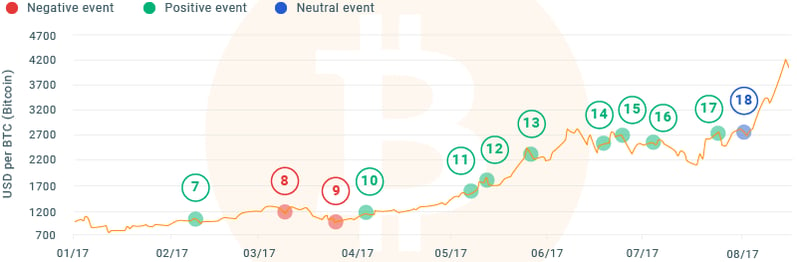

First, we compare Bitcoin price development with silver, oil and Nasdaq Composite from periods when these markets experienced a massive surge in price followed by a crash. We chose relatively recent bubbles because of data availability (unfortunately there is no daily time series on Tulip prices from the 17th century) and selected the silver peak in 1980, the Nasdaq Composite that reached a high in 2000 and oil from the “peak oil” period that culminated in 2008.

Because timelines of these price developments differ, we simply choose the 1st of January of a year preceding a crash for a starting point. One thing is common for all these markets including Bitcoin: there’s a period when price increases are relatively modest which is followed by a rapid price explosion. Similarities end at this point, though. We can see that oil and the Nasdaq look very benign in comparison to silver and Bitcoin. This is partly because these markets were on the rise for years heading into the crash. While the boom and bust of the silver market in 1980 was far more dynamic, it still pales in comparison to recent developments in the Bitcoin price.

Contemporary financial bubbles

January of the year preceding a peak = 100 (January 2016 for Bitcoin)

Bitcoin rally has already exceeded range of relatively recent market bubbles. Source: Macrobond

So is Bitcoin in a bubble? Some of the characteristics of previous bubbles are present here. We see price surge accompanied by huge volatility. We observe an explosion of interest from potential users, media and investors. When prices of silver, oil and tech stocks exploded, traditional valuation metrics were questioned and arguments for much higher prices were abundant. In the case of Bitcoin it is hard to conduct any valuation at all so prices lack this kind of “anchor”. Finally there is a spree of Initial Coin Offerings - new applications of blockchain technologies that promise investors major returns. Some of these projects might be successful but it is reminiscent of dot.com IPOs in late 90s where many companies were able to secure financing despite lacking business operations that would generate any cash flows. Obviously, despite these similarities, we cannot be sure that Bitcoin is in a bubble until a crash actually occurs.

Section 5

Bitcoin and other cryptocurrencies

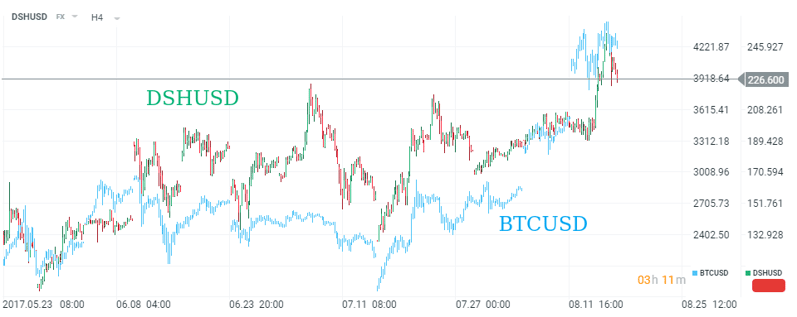

Let’s proceed with a brief description of four other major cryptocurrencies: Ethereum, Litecoin, Ripple and Dash.

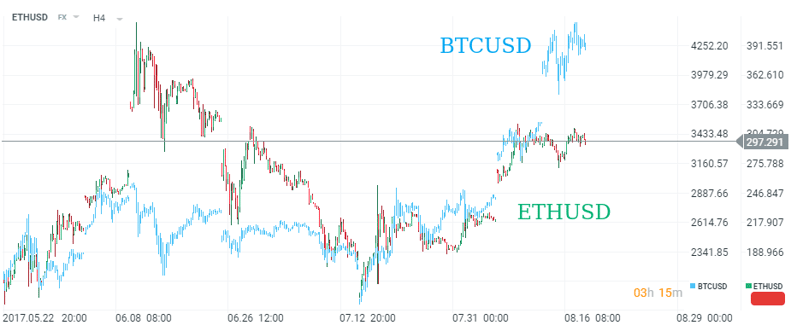

Ethereum (ETHUSD is the Ethereum-based CFD on xStation platform) is perceived as a major competitor for Bitcoin as it has a broader set of applications, including peer-to-peer security exchanging, bets or crowdfunding. Its confirmation system is similar to Bitcoin and miners receive Ethers as a reward for finding a block. Looking at the chart we can see that ETHUSD outperformed BTCUSD towards the end of second quarter but has lagged behind quite considerably since then.

Source: xStation5

Source: xStation5

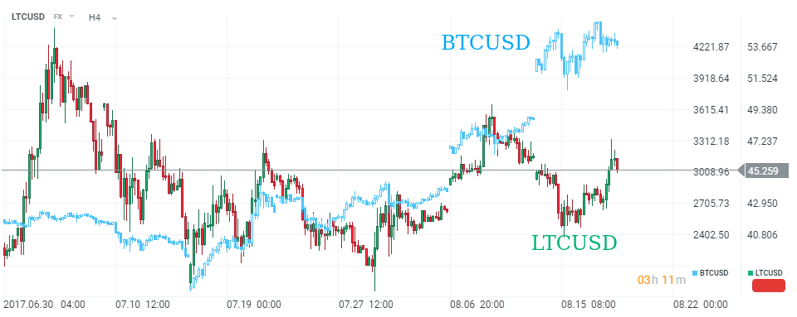

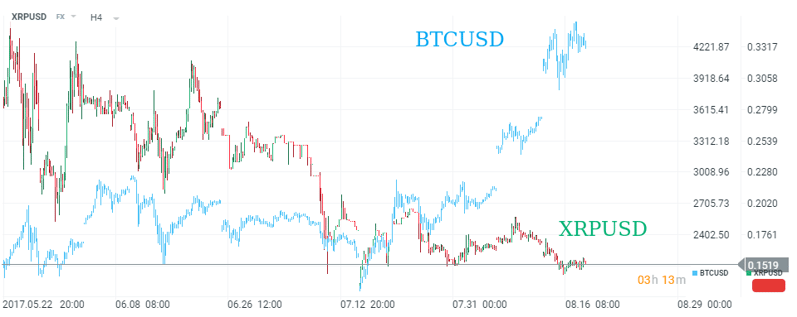

Ripple (XRPUSD is Ripple-based CFD on xStation platform) is a bit different as this cryptocurrency is not mined. There is 100 billion XRP and one unit is destroyed when a transaction is being confirmed. Ripple is supposed to be a real-time transaction system and some banks are experimenting with the currency so in theory it could be serious competition for Bitcoin. Unlike other cryptocurrencies, XRPUSD has been in a downward trend recently.

Source: xStation5

Source: xStation5

Some traders may have strong views on cryptocurrencies while others may prefer following trends. Here we present two techniques that may aid joining strong trends on financial markets: “broken zones” and “moving averages”. They can be applied to traditional markets and could work with cryptocurrencies as well.

Source: xStation5

On the first chart we can see Bitcoin prices (BTCUSD, Bitcoin-based CFD on the xStation platform) rallying from $3800 to above $4400 in a matter of hours. A technique of broken zones assumes that when there is an upward trend and important level that used to function as a resistance but got broken, prices could treat this level as a support and rebound from it (the opposite is true for a downward trend). In this case there was an upward trend (a sequence of higher lows and higher highs) and an important level of $4200 got broken in a decisive way. We can see that prices used this level as a support later and continued a rally.

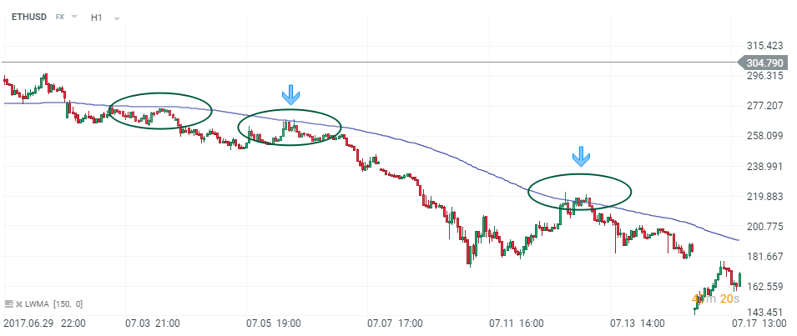

Source: xStation5

A second chart depicts a period of price decline on Ethereum (ETHUSD) in early July 2017. When a trend is relatively pervasive, a moving average can act as a support in an upward trend and a resistance in a downward trend. In this case we can see that a 150-hour moving average acted as a resistance and price respected it and continued a decline.

Conclusions

The price of Bitcoin has seen a massive rally in 2016 and so far in 2017 as cryptocurrencies gain traction on financial markets and their acceptance broadened. There is a general consensus that blockchain technology can be considered as breakthrough technology, especially in the financial industry but this does not need to imply higher Bitcoin prices in the future. While there are many symptoms of a speculative bubble, there are also multiple optimistic opinions. Traders who want to take advantage of trends in cryptocurrency markets may also use technical analysis to look for trading opportunities.

Trading CFDs based on cryptocurrencies is extremely risky due to significant volatility and the use of leverage. Losses can exceed deposits.

*Source: Macrobond, data covering 01.01.2017-17.08.2017; please see the chart "Bitcoin price in USD"

1. https://bitinfocharts.com/comparison/bitcoin-transactionfees.html

2. As of August 17 2017

3. https://blockchain.info/

4. https://twitter.com/RonnieMoas

5. https://www.cnbc.com/2017/08/14/standpoints-ronnie-moas-raises-bitcoin-price-target-to-7500.html

6. https://qz.com/1047848/btc-price-the-case-for-5000-bitcoin/

7. https://www.cnbc.com/2017/05/31/bitcoin-price-forecast-hit-100000-in-10-years.html

8. http://www.businessinsider.com/bitcoin-price-could-be-500000-by-2030-first-snapchat-investor-says-2017-3?IR=T

9. https://ftalphaville.ft.com/2017/05/22/2189145/how-to-value-bitcoin-with-a-traditional-valuation-measure/?mhq5j=e1

Why you should choose XTB?

Attractive investments conditions

One of the leading brokers in online investments

- Stock exchange listed, regulated by the KNF/Financial Conduct Authority/CMB (depending on the market)

- Global FX and CFDs broker with offices in 11 countries

Innovative platforms

- Ultra-fast trade execution with an average time of 85 millisecond

- Advanced platforms for smartphones, tablets and smartwatches

- Both xStation and MT4 available for trading

Personalized education

- Trading Academy containing tutorials, walkthroughs and trading courses

- Live webinars that allow to interact with our team of market experts

Advanced market research

- Full market coverage from XTB analysts

- Advanced research reports on the most important events

Advanced technology

- Advanced chart trading that allows to trade right from the chart

- Access to many technical indicators including Fibonacci Retracement, Moving Averages, RSI and more

- Trader’s talk - live audio feed and latest market news directly in the platform

Loyalty Rewards

- Cashback on closed trades*

- Refer a friend bonus - invite a friend and get a bonus*

Multiple award-winners:

- Winner of the “Best Trading Platform 2016”**

- Best in the “Bloomberg EMEA forecasts” ranking in 2016***

Why you should choose XTB?

**by Online Personal Wealth Awards

***X-Trade Brokers was award #1 FX forecaster on Bloomberg for 2016. XTB Ltd is a subsidiary of X-Trade Brokers."

This report is provided for general information and marketing purposes only. Any opinions, analyses, prices or other content does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. XTB will not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Losses can exceed your deposits and you may be required to make further payments. Please bear in mind that volatility increases the risks. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. When XTB provides trading analysis and/or research, the author of this article may have an interest in the instruments mentioned. XTB has policies in place to identify and manage any conflicts of interest that may arise in the production of research and the provision of trading analysis.